20 questions to tell

if you are ready

to retire

Get matched with a Wealth Manager/Advisor

Join Us

Find Your advisor/wealth manager match

FINANCIAL SERVICES SPOTLIGHT

The Financial Services Industry in the United States

OVERVIEW

Financial markets in the United States are the largest and most liquid in the world. In 2018, finance and insurance represented 7.4 percent (or $1.5 trillion) of U.S. gross domestic product. Leadership in this large, high-growth sector translates into substantial economic activity and direct and indirect job creation in the United States.

Financial services and products help facilitate and finance the export of U.S. manufactured goods and agricultural products. In 2017, the United States exported $114.5 billion in financial services and insurance and had a $40.8 billion surplus in financial services and insurance trade (excluding re-insurance, the financial services and insurance sectors had a surplus of $69.6 billion). The financial services and insurance sectors employed more than 6.3 million people at the end of 2018.

Retirement Planning System for Wealth Managers/Financial Advisors

Technology when used for good can change the world.

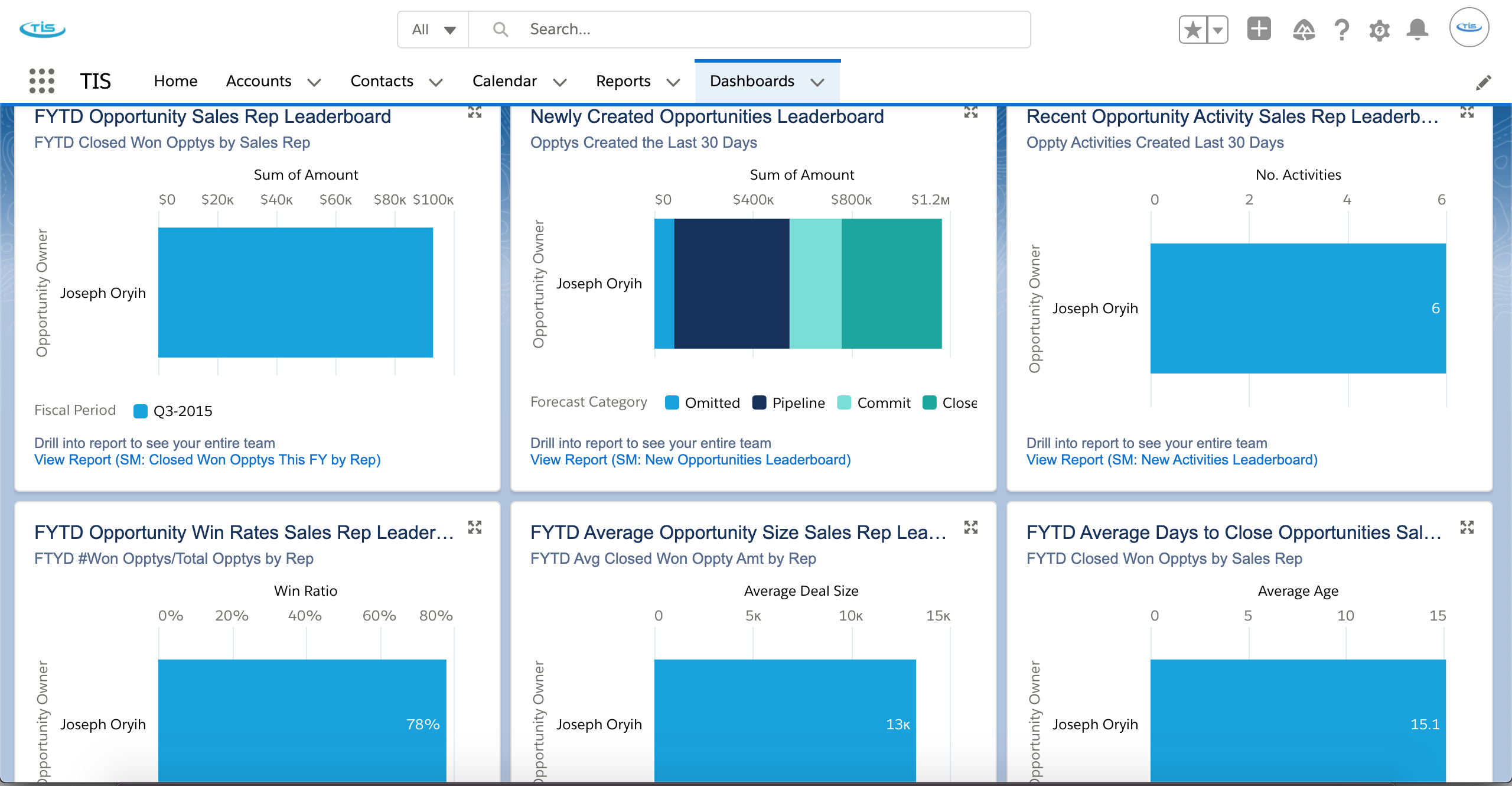

Our system will transform the entire process between wealth managers/advisors and their clients, and also give clients the information they’re looking for towards their retirement goals. Your clients have specific retirement questions and we are the expert to empower them with specific retirement strategies.

We’re bringing wealth managers and clients together in one unique platform.

We are is proud to partner with financial professionals, wealth managers, and financial advisors to create the most engaging experience for our clients. We’re your partner for expert industry intelligence you can trust.

Unlimited Partner Community Membership (Flexible) Plan

Online Appointment Center

Paycheck Analysis

Converting your clients to sales

Will we have enough when we retire?

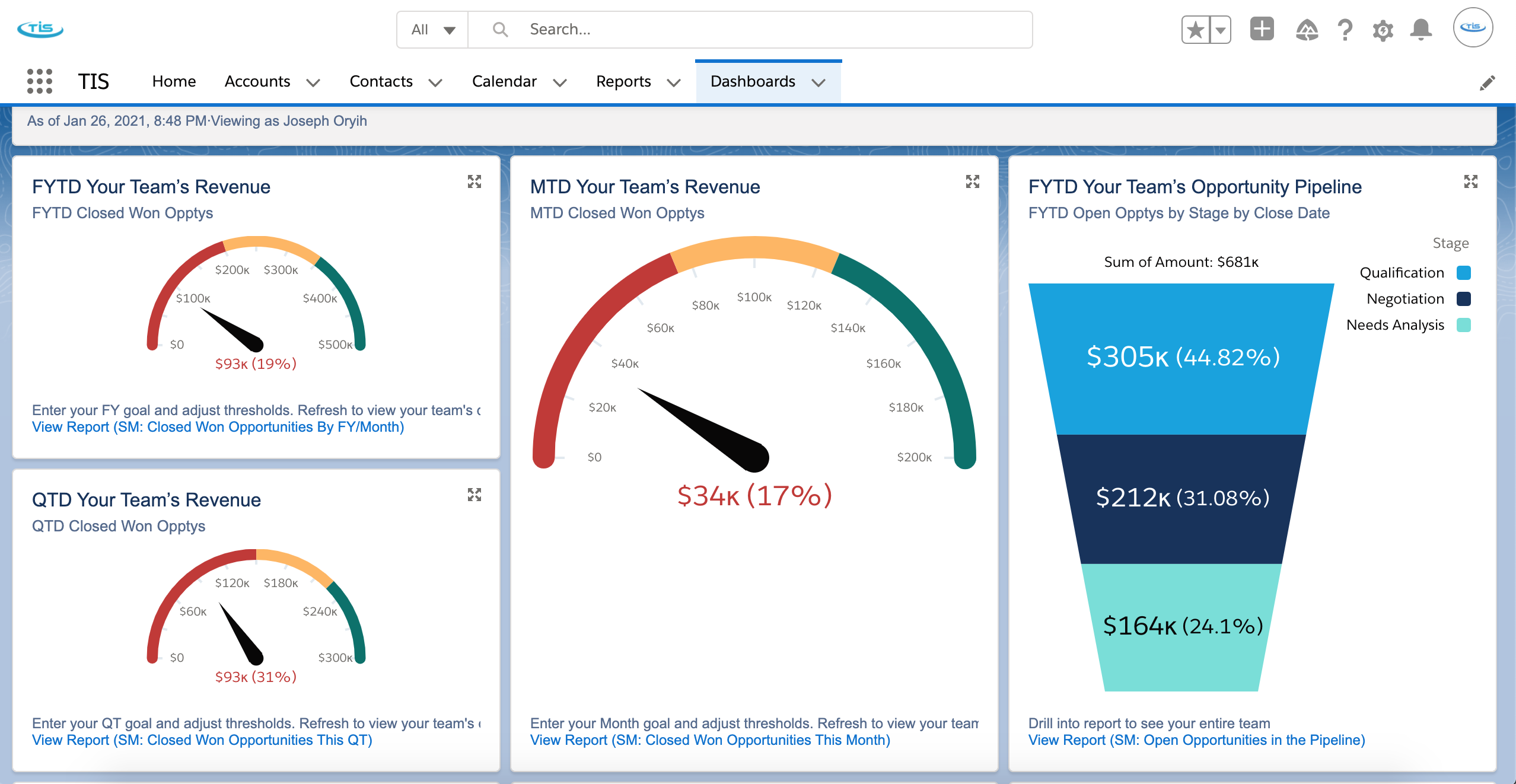

It’s the burning question most clients ask. The system gives wealth manager/advisor the ability to illustrate a split annuity (between two and five tiers), quickly showing a client the income that can be produced from a lump sum value, or working backwards; it can also calculate the cash balance needed to produce a required income.

Financial Planning

In the financial planning arena, it’s been said for years that accumulation and distribution are different. But what does that mean? The Tax Wise Distribution Strategy definitively articulates the differences and provides clients the maximum after-tax income in retirement. Wealth manager/advisor using the strategy can clearly share with clients how their advice is easy to understand, solid and advantageous to their financial futures.

Retirement Analysis

Income Gap

The illustration software will show the income Gap/Shortfall which the wealth manager/advisor can leverage in order to encourage the client to save the maximum amounts through investments and Life Insurance.

Public Employee Options

Defined Benefit Programs applies to clients who are teachers; federal, state or municipal government employees. The online Gap Analysis software is a tool which allows wealth managers/advisors a simple process to illustrate over 650 pension plans throughout the US.